13th District legislators share worries over WA taxation, spending

EPHRATA – The 13th District’s trio of state legislators recently shared with local officials their observations on Washington’s 2025 lawmaking session earlier this year in Olympia – and their worries about a troubling revenue forecast despite significant new taxes levied on businesses.

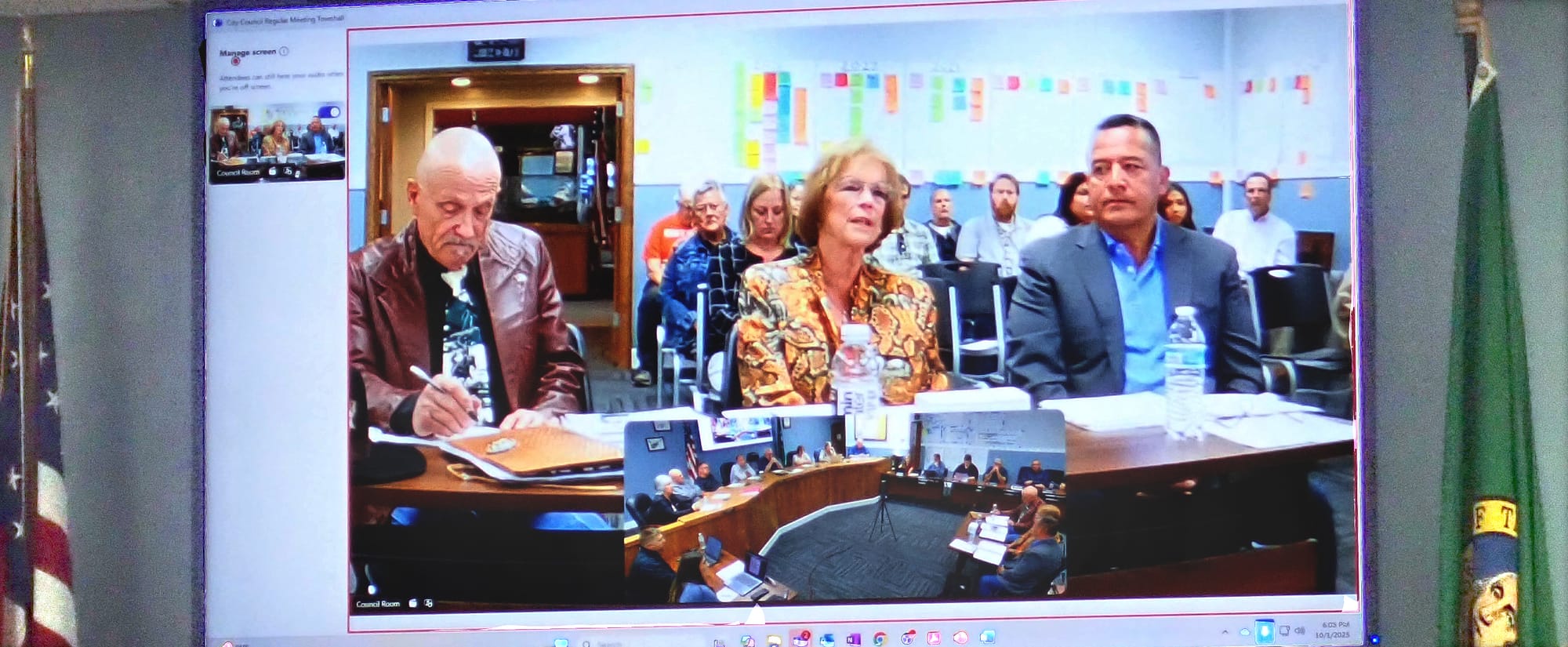

“I am concerned about our state and what we have done,” state Sen. Judy Warnick, R-Moses Lake, told Ephrata City Council members during their Oct. 1 meeting.

Warnick, who serves on the Senate Ways and Means committee, attended the council session with her two House counterparts, Reps. Tom Dent of Moses Lake and Alex Ybarra of Quincy, both fellow Republicans.

They noted that state Democrats, who hold the legislative majority and governor’s office in Olympia, passed measures that impose $3.6 billion in new taxes, which Dent called the largest tax increase in state history.

In particular, there is reference to narrowly passed Engrossed Substitute Senate Bill 5814, which took effect Oct. 1 and will now add retail sales tax to the activities of thousands of businesses.

The three lawmakers said that will ultimately affect all Washingtonians. They noted that even in liberal Seattle, the sweeping sales tax hikes seemed profound, with the Seattle Times’ editorial board calling the measures “a reckless way to craft foundational economic policy.”

In February, Gov. Bob Ferguson also called for reducing state spending by least $4 billion this year, saying Washington faces a budget shortfall of least $12 billion over the next four years.

But despite the new taxes and Ferguson’s request for spending cuts, a revenue forecast released in September indicated the state is already facing a $421 million revenue shortfall heading into 2026, said Warnick.

“We are already underwater … even before the end of the year,” she said, calling the fiscal news “pretty dire.”

The combination of increasing taxes and regulations – from childcare to technology services -- are driving some companies out of state or out of business, the three lawmakers said.

But in central Washington – a prime agricultural region – farmers and other ag operators “just can’t pick up and move,” said Warnick.

Dent, a member of the House Agriculture and Natural Resources Committee, said those impacts are “a major cause (of stress) in the ag sector” and a factor in the high suicide rates seen in farm communities here and across the nation.

“It’s real, it’s here, it’s a stigma,” he said.

Ybarra, who worked for Grant County PUD for nearly two decades and serves on the House Work Force, Labor, and Environment/Energy committees, said the state’s push for green energy under former Gov. Jay Inslee imposes an unrealistic timeline for shifting to mass electrification of vehicles, industry, and housing by year 2035.

“I’m an energy guy,” said Ybarra, but he predicted there is “no way” Washington will be totally “electrified” within the next decade.

Ybarra faulted the state’s refusal to recognize hydropower as a renewable energy source and the burden placed on utility districts like Grant PUD to provide needed – and expensive -- infrastructure for the transition.

“We need to change the laws to make it realistic,” he said.

In a segue, Dent said at least some revenue from the state’s Climate Commitment Act should be allocated to address much-needed transportation improvements, including road construction and maintenance, in part because of the growing number of electric vehicles.

EVs factor into road wear and infrastructure demands, Dent indicated, but their owners don’t contribute a fair share compared to drivers of conventional vehicles who pay the nation’s highest gas tax.

A proposed mileage tax seems highly unpopular with the public, said Dent, but particularly for rural residents who often travel greater distances for work, school, and services and have less available public transportation than urban dwellers.

Overall, the 2025 legislative session was “particularly contentious,” said Dent. “There was some anger in the chambers.”

Several Ephrata council members asked whether the divide in priorities -- between Democrats and Republicans, and rural and urban residents -- could be bridged.

Ybarra said that varies within different committees, but he believed there has been a “mindset” shift by Democrats on the House Environment and Energy Committee in facing the challenges of the state’s green energy laws.

Dent spoke of a “bright spot” in working with Democratic Lt. Gov. Denny Heck and some House members in bolstering relationships between the two political caucuses. “But that doesn’t happen overnight,” he said.

Warnick said she has a good relationship with Senate Democratic caucus leader Jamie Pedersen of Seattle. “But he’s deep downtown Seattle,” she said, wryly noting that Pedersen’s constituency is “very different” from many residents in central Washington.

But that’s part of the job, said Warnick. “We have to walk across the aisle and work with people.”